$2,500 Alaska Notary Bond

$40.00

This $40 AK notary surety bond complies with the Alaska state law requiring notary applicants to file a $2,500 Alaska notary bond. The surety bond protects the people of Alaska from financial harm resulting from any mistakes the notary might make.

In order to protect the notary’s personal financial assets, we highly recommend purchasing Errors & Omissions Insurance (E&O). Without an E&O policy, the notary will be responsible for reimbursing any bond claims, and for the cost of potential legal defense fees.

- Description

- AK Notary Bond Content

- AK Notary E&O Content

Description

Alaska Notary Bond

All new and renewing notaries in Alaska are required by state law to have a $2,500, 4-year notary bond. Add Notary E&O Insurance covering the term of your commission.

The Travelers bond and insurance combo may only be purchased at the beginning of a commission term. In order to qualify for this product combination, you must meet our underwriting guidelines and purchase within six months of the start of the commission. If you fail to meet the underwriting guidelines, your payment will be refunded.

How to file your Alaska notary public surety bond

Submit your completed application and bond online, or mail to:

Office of Lt. Governor

Notary Public Office

240 Main Street, Room 301

Juneau, AK 99801

Follow this link for the Alaska Notary Public Application Instructions

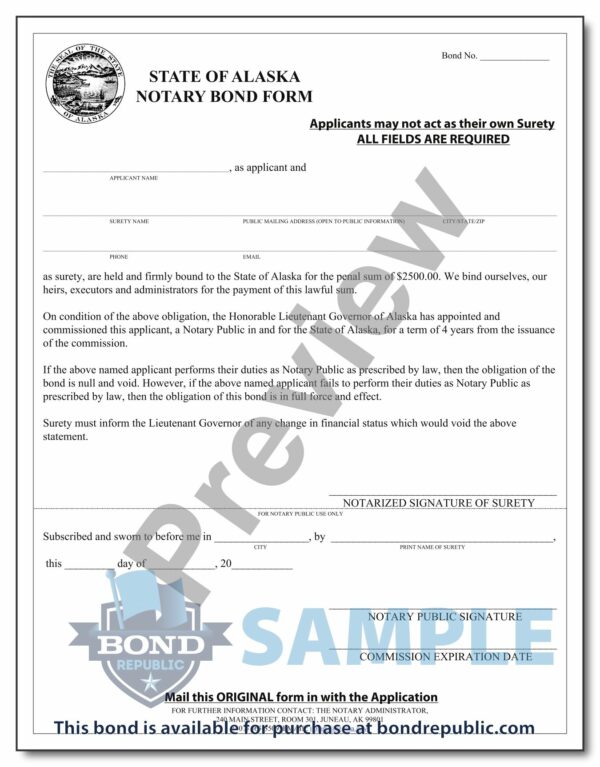

Bond No. _______________

STATE OF ALASKA

NOTARY BOND FORM

Applicants may not act as their own Surety

Preview

ALL FIELDS ARE REQUIRED

___________________________________________________________________, as applicant and

APPLICANT NAME

_________________________________________________________________________________________________________________________________________________________________________________________

SURETY NAME PUBLIC MAILING ADDRESS (OPEN TO PUBLIC INFORMATION) CITY/STATE/ZIP

_________________________________________________________________________________________________________________________________________________________________________________________

PHONE EMAIL

as surety, are held and firmly bound to the State of Alaska for the penal sum of $2500.00. We bind ourselves, our

heirs, executors and administrators for the payment of this lawful sum.

On condition of the above obligation, the Honorable Lieutenant Governor of Alaska has appointed and

commissioned this applicant, a Notary Public in and for the State of Alaska, for a term of 4 years from the issuance

of the commission.

If the above named applicant performs their duties as Notary Public as prescribed by law, then the obligation of the

bond is null and void. However, if the above named applicant fails to perform their duties as Notary Public as

prescribed by law, then the obligation of this bond is in full force and effect.

Surety must inform the Lieutenant Governor of any change in financial status which would void the above

statement.

_________________________________________

NOTARIZED SIGNATURE OF SURETY

FOR NOTARY PUBLIC USE ONLY

Subscribed and sworn to before me in _________________, by ________________________________________,

CITY PRINT NAME OF SURETY

this _________ day of ____________, 20___________

_________________________________________

NOTARY PUBLIC SIGNATURE

_________________________________________

COMMISSION EXPIRATION DATE

Mail this ORIGINAL form in with the Application

FOR FURTHER INFORMATION CONTACT: THE NOTARY ADMINISTRATOR,

240 MAIN STREET, ROOM 301, JUNEAU, AK 99801

(907) 465-3509, EMAIL: notary@alaska.gov

—————————————————–

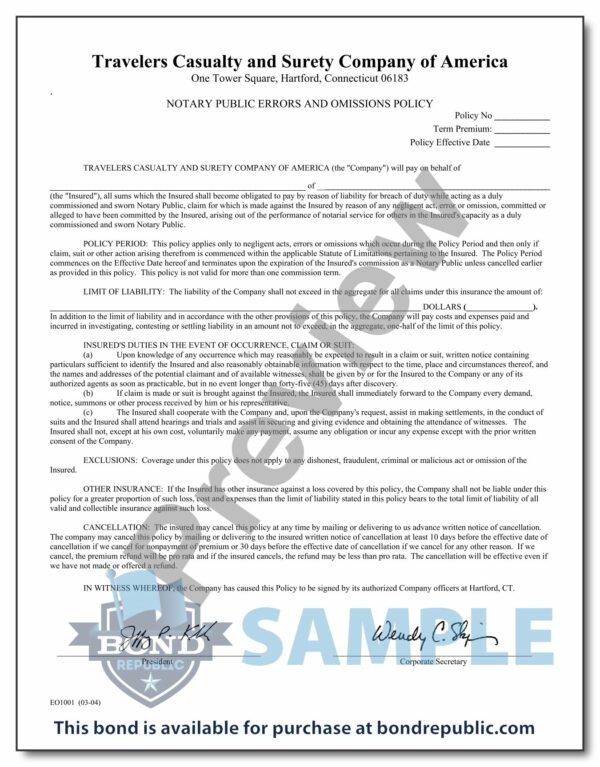

Travelers Casualty and Surety Company of America

One Tower Square, Hartford, Connecticut 06183

NOTARY PUBLIC ERRORS AND OMISSIONS POLICY

Policy No ____________

Term Premium: ____________

Preview

Policy Effective Date ____________

TRAVELERS CASUALTY AND SURETY COMPANY OF AMERICA (the “Company”) will pay on behalf of

______________________________________________ of ________________________________________________________

(the “Insured”), all sums which the Insured shall become obligated to pay by reason of liability for breach of duty while acting as a duly

commissioned and sworn Notary Public, claim for which is made against the Insured by reason of any negligent act, error or omission, committed or

alleged to have been committed by the Insured, arising out of the performance of notarial service for others in the Insured’s capacity as a duly

commissioned and sworn Notary Public.

POLICY PERIOD: This policy applies only to negligent acts, errors or omissions which occur during the Policy Period and then only if

claim, suit or other action arising therefrom is commenced within the applicable Statute of Limitations pertaining to the Insured. The Policy Period

commences on the Effective Date hereof and terminates upon the expiration of the Insured’s commission as a Notary Public unless cancelled earlier

as provided in this policy. This policy is not valid for more than one commission term.

LIMIT OF LIABILITY: The liability of the Company shall not exceed in the aggregate for all claims under this insurance the amount of:

_________________________________________________________________________________________ DOLLARS (________________).

In addition to the limit of liability and in accordance with the other provisions of this policy, the Company will pay costs and expenses paid and

incurred in investigating, contesting or settling liability in an amount not to exceed, in the aggregate, one-half of the limit of this policy.

INSURED’S DUTIES IN THE EVENT OF OCCURRENCE, CLAIM OR SUIT:

(a) Upon knowledge of any occurrence which may reasonably be expected to result in a claim or suit, written notice containing

particulars sufficient to identify the Insured and also reasonably obtainable information with respect to the time, place and circumstances thereof, and

the names and addresses of the potential claimant and of available witnesses, shall be given by or for the Insured to the Company or any of its

authorized agents as soon as practicable, but in no event longer than forty-five (45) days after discovery.

(b) If claim is made or suit is brought against the Insured, the Insured shall immediately forward to the Company every demand,

notice, summons or other process received by him or his representative.

(c) The Insured shall cooperate with the Company and, upon the Company’s request, assist in making settlements, in the conduct of

suits and the Insured shall attend hearings and trials and assist in securing and giving evidence and obtaining the attendance of witnesses. The

Insured shall not, except at his own cost, voluntarily make any payment, assume any obligation or incur any expense except with the prior written

consent of the Company.

EXCLUSIONS: Coverage under this policy does not apply to any dishonest, fraudulent, criminal or malicious act or omission of the

Insured.

OTHER INSURANCE: If the Insured has other insurance against a loss covered by this policy, the Company shall not be liable under this

policy for a greater proportion of such loss, cost and expenses than the limit of liability stated in this policy bears to the total limit of liability of all

valid and collectible insurance against such loss.

CANCELLATION: The insured may cancel this policy at any time by mailing or delivering to us advance written notice of cancellation.

The company may cancel this policy by mailing or delivering to the insured written notice of cancellation at least 10 days before the effective date of

cancellation if we cancel for nonpayment of premium or 30 days before the effective date of cancellation if we cancel for any other reason. If we

cancel, the premium refund will be pro rata and if the insured cancels, the refund may be less than pro rata. The cancellation will be effective even if

we have not made or offered a refund.

IN WITNESS WHEREOF, the Company has caused this Policy to be signed by its authorized Company officers at Hartford, CT.

____________________________________________ ___________________________________________

President Corporate Secretary

EO1001 (03-04)

—————————————————–

ISSUED BY: POLICY NO:

ISSUED TO:

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

CANCELLATION/NONRENEWAL – ALASKA

FULL CANCELLATION – INSURER

Preview

It is agreed that:

1. The policy provisions regarding cancellation by the Company are deleted and replaced with the following:

A. We may cancel this Policy by mailing to the entity named in Item 1 of the Declarations and to the agent or broker of record

written notice of cancellation at least:

(a) 20 days before the effective date of cancellation if we cancel for:

1) nonpayment of premium, or

2) failure or refusal of the insured to provide the information necessary to determine the policy premium.

(b) 10 days before the effective date of cancellation if we cancel for:

1) conviction of the insured of a crime having as one of its elements an act increasing a hazard insured

against, or

2) discovery of fraud or material misrepresentation made by the insured, or a representative of the insured, in

obtaining the insurance, or by the insured in pursuing a claim under the Policy.

(c) 60 days before the effective date of cancellation if we cancel for any other reason not specified in (a) or (b) above.

B. Cancellation shall be effective at the date set forth in such notice of cancellation, unless however payment is made within 20

days of the entity’s receipt of a notice of cancellation for nonpayment of premium. The Company shall have the right to the

premium amount for the portion of the Policy Period during which the Policy was in effect.

C. If the Company cancels, the Company will return, as the refund, the pro rata unearned premium to the entity named in Item 1

of the Declarations or, if applicable, to the premium finance company before the effective date of cancellation if the

Company cancels for any reason not specified in (a) or (b) above. If the Company cancels for one of the reasons specified in

(a) or (b) above, the Company will return, as the refund, the pro rata unearned premium to the entity named in Item 1 of the

Declarations or, if applicable, to the premium finance company within 45 days after notice of cancellation is given. The

notice of cancellation will state the effective date of cancellation. The Policy Period will end on that date.

2. The policy provisions regarding cancellation by the entity named in Item 1 of the Declarations are deleted and replaced with the

following:

A. The entity named in Item 1 of the Declarations may cancel this Policy by mailing to the Company written notice stating when

thereafter, but not later than the Expiration Date set forth in the Declarations, such cancellation will be effective. If the entity

named in Item 1 of the Declarations cancels, the refund will be the pro rata unearned premium minus a cancellation fee of

7.5 of the pro rata unearned premium. However, the Company will not retain this cancellation fee if this Policy is

canceled:

a. and rewritten with the Company or in the company group; or

b. at the Company’s request; or

c. because the entity named in Item 1 of the Declarations no longer has a financial or insurable interest in the property or

business operation that is the subject of this insurance; or

d. after the first year for a prepaid Policy written for a term of more than one year.

3. The premium for this Policy:

a. May be earned at a varying rate; or

b. May be subject to a minimum; or

c. May have a fluctuating base.

4. The following is added and supersedes any other provision to the contrary:

NONRENEWAL

A. If we decide not to renew this Policy, we will mail written notice of nonrenewal to the entity named in Item 1 of the

Declarations, at least 45 days before its expiration date, or its anniversary date if it is a Policy written for a term of more than one

ILT-5002 (06-04)

—————————————————–

year or with no fixed expiration date.

The Company need not mail notice of nonrenewal if:

a. The Company has manifested in good faith a willingness to renew; or

b. The entity named in Item 1 of the Declarations has failed to pay any premium required for this Policy; or

c. The entity named in Item 1 of the Declarations fails to pay the premium required for renewal of this Policy.

5. The Company will mail the notice of cancellation or nonrenewal to the last known address of the entity named in Item 1 of the

Declarations and the last known address of the agent or broker of record. A post office certificate of mailing or certified mail

receipt will be sufficient proof of mailing of notice.

6. If the premium to renew this Policy increases more than 10 for a reason other than an increase in coverage or exposure basis, or

if after the renewal there will be a material restriction or reduction in coverage not specifically requested by the entity named in

Item 1 of the Declarations, the Company will mail written notice to the last known address of the entity named in Item 1 of the

Declarations and the last known address of the agent or broker of record at least 45 days before:

a. The expiration date; or

b. The anniversary date if this Policy has been written for more than one year or with no fixed expiration date.

Nothing herein contained shall be held to vary, alter, waive or extend any of the terms, conditions, exclusions or limitations of the

above mentioned policy, except as expressly stated herein. This endorsement is effective at the inception date stated in the

Declarations and this endorsement is part of such policy and incorporated therein.

Preview

ILT-5002 (06-04)

—————————————————–

ISSUED BY: POLICY NO:

ISSUED TO:

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

CANCELLATION/NONRENEWAL – ALASKA

CANCELLATION FOR NONPAYMENT OF PREMIUM

It is agreed that:

1. The policy provisions regarding cancellation by the Company are deleted and replaced with the following:

A. We may cancel this Policy for nonpayment of premium by mailing to the entity named in Item 1 of the Declarations and to

the agent or broker of record written notice of cancellation at least 20 days before the effective date of cancellation.

Cancellation shall be effective at the date set forth in such notice of cancellation, unless however payment is made within 20

days of the entity’s receipt of such notice of cancellation. The Company shall have the right to the premium amount for the

portion of the Policy Period during which the Policy was in effect. If the Company cancels, the Company will return, as the

refund, the pro rata unearned premium to the entity named in Item 1 of the Declarations or, if applicable, to the premium

finance company within 45 days after notice of cancellation is given. The notice of cancellation will state the effective date

of cancellation. The Policy Period will end on that date.

2. The policy provisions regarding cancellation by the entity named in Item 1 of the Declarations are deleted and replaced with the

following:

A. The entity named in Item 1 of the Declarations may cancel this Policy by mailing to the Company written notice stating when

thereafter, but not later than the Expiration Date set forth in the Declarations, such cancellation will be effective. If the entity

named in Item 1 of the Declarations cancels, the refund will be the pro rata unearned premium minus a cancellation fee of

7.5 of the pro rata unearned premium. However, the Company will not retain this cancellation fee if this Policy is

canceled:

Preview

a. and rewritten with the Company or in the company group; or

b. at the Company’s request; or

c. because the entity named in Item 1 of the Declarations no longer has a financial or insurable interest in the property or

business operation that is the subject of this insurance; or

d. after the first year for a prepaid Policy written for a term of more than one year.

3. The premium for this Policy:

a. May be earned at a varying rate; or

b. May be subject to a minimum; or

c. May have a fluctuating base.

4. The following is added and supersedes any other provision to the contrary:

NONRENEWAL

A. If we decide not to renew this Policy, we will mail written notice of nonrenewal to the entity named in Item 1 of the

Declarations, at least 45 days before its expiration date, or its anniversary date if it is a Policy written for a term of more than one

year or with no fixed expiration date.

The Company need not mail notice of nonrenewal if:

a. The Company has manifested in good faith a willingness to renew; or

b. The entity named in Item 1 of the Declarations has failed to pay any premium required for this Policy; or

c. The entity named in Item 1 of the Declarations fails to pay the premium required for renewal of this Policy.

5. The Company will mail the notice of cancellation or nonrenewal to the last known address of the entity named in Item 1 of the

Declarations and the last known address of the agent or broker of record. A post office certificate of mailing or certified mail

receipt will be sufficient proof of mailing of notice.

6. If the premium to renew this Policy increases more than 10 for a reason other than an increase in coverage or exposure basis, or

if after the renewal there will be a material restriction or reduction in coverage not specifically requested by the entity named in

ILT-5003 (06-04)

—————————————————–

Item 1 of the Declarations, the Company will mail written notice to the last known address of the entity named in Item 1 of the

Declarations and the last known address of the agent or broker of record at least 45 days before:

a. The expiration date; or

b. The anniversary date if this Policy has been written for more than one year or with no fixed expiration date.

Nothing herein contained shall be held to vary, alter, waive or extend any of the terms, conditions, exclusions or limitations of the

above mentioned policy, except as expressly stated herein. This endorsement is effective at the inception date stated in the

Declarations and this endorsement is part of such policy and incorporated therein.

Preview

ILT-5003 (06-04)